WhatsApp Pay is a payment feature on WhatsApp messaging service – a popular messenger app that allows users to send and receive money. The utilization of WhatsApp Pay can be the solution for various businesses when it comes to the process of collecting payments. With this feature, they can receive payments from customers for their products and services efficiently.

Furthermore, WhatsApp Pay can be leveraged for invoicing, sending payment reminders and providing payment assistance.

Moreover, the platform provides businesses the chance of promoting products and services using offers and promotions, directly interacting with the customers.

In this post, we will talk about what WhatsApp Pay is and how it works. You will also learn quite useful tips that will teach you how to use WhatsApp for Business to get more customers or grow your business.

So, let’s get started…

What Is WhatsApp Pay?

WhatsApp has added an in-chat payment feature named WhatsApp Pay. This feature enables WhatsApp users to transfer and receive funds from their contact lists. The payment architecture works on the Unified Payments Interface (UPI) method. That means users can transfer funds without adding or sharing any bank details.

WhatsApp Pay’s UPI interface enables users to make instant fund transfers through a virtual address. The fund transfer process is fast and easy and can be done 24/7, 365 days a year.

When Was WhatsApp Pay Introduced?

The trial version of WhatsApp Pay was launched in India in February 2018. On February 7, 2020, it received NPCI’s app approval to launch its digital payments service systematically, and it was officially launched in November 2020.

How Do You Make A Payment Using WhatsApp’s In-Chat Payment Feature?

WhatsApp’s In-Chat Payment feature allows you to easily transfer funds without leaving your conversation. To initiate a payment, follow these simple steps:

- Open the chat window of the person you want to send money to.

- Look for the ‘Rupee’ symbol under the ‘Attachment’ option and click on it.

- Enter the amount you wish to transfer and your UPI PIN.

- Confirm the transaction.

For Android users, the process is as follows:

- Open the chat window of the person you want to send money to.

- Click on the attachment icon.

- Select ‘Payment’ and accept the terms and conditions.

- To complete the transaction, just enter the amount and UPI.

For iOS users, follow these steps:

- Open the chat window of the person you want to send money to.

- Click on the plus symbol.

- Select ‘Payment’ and follow the steps from there.

With WhatsApp’s In-Chat Payment feature, sending money is quick, easy, and secure, all within the chat window.

Related: How To Use WhatsApp For Business? (Top 10 Tips & Tricks)

Features Of WhatsApp Pay

WhatsApp Pay is equipped with several useful features. Some of them are listed below:

Integration With WhatsApp

The pay feature is embedded within the messaging app. Which makes it easy to use for users

Secure Payments

Facilitates secure transactions using the Unified Payments Interface (UPI). Users just need to link their verified bank account to WhatsApp to use this feature.

Send And Receive Money

Users can send money to their contacts using WhatsApp Pay and request money from contacts who owe them.

Transactions History

WhatsApp Pay efficiently maintains a record of transaction history, allowing users to track their payments and receipts.

Multi-Bank Support

WhatsApp Pay supports multiple banks, allowing users to link their preferred bank account for transactions.

Payments In Chats

Users can initiate payments directly from their chat window by clicking on the attachment icon and selecting “Payment.”

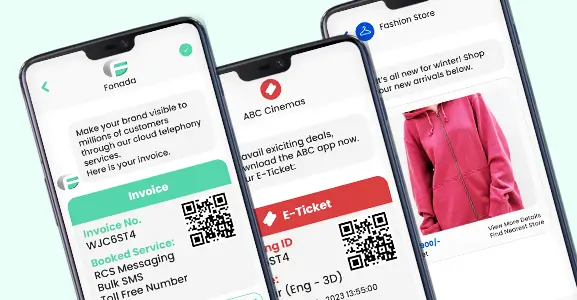

QR Code Payments

WhatsApp Pay supports QR code payments, allowing users to scan QR codes to make payments easily.

UPI PIN

To ensure security standards, users need to enter their UPI PIN to authenticate each transaction.

Transaction Limits

The pay feature has limits on the amount of money that can be sent in a single transaction and within a certain period to comply with UPI regulations.

Notifications

Users receive notifications for successful transactions and other important updates related to WhatsApp Pay.

These features make WhatsApp Pay a convenient and secure way to send and receive funds using the WhatsApp Messaging App.

Related: What Are WhatsApp Channels ? (+How Do They Work?)

Benefits Of WhatsApp Pay For Businesses

WhatsApp Pay has changed the way businesses handle payments. It offers a seamless experience directly within the messaging platform. With over 50 million businesses on the WhatsApp Business App and a staggering 2.3 billion active users, this feature presents a multitude of benefits and opportunities for businesses.

It allows businesses to accept payments directly within WhatsApp using UPI, debit/credit cards, and net banking. Moreover, it enables businesses to offer a complete shopping experience on WhatsApp, from browsing products to making payments and receiving order confirmations.

The key advantages of WhatsApp Pay for businesses are listed below:

Streamlined Process

Businesses can send payment requests and reminders directly in chat. This eliminates the need for customers to leave the platform or download additional apps, which reduces drop-offs.

Increased Trust

WhatsApp business is a reliable platform known for offering an advanced and interactive user interface for messaging. Now, the payment option is one of its handy features. Payments here enhance brand trustworthiness, as customers can transact in a familiar environment.

Enhanced Security

The pay feature is highly advanced and backed by UPI’s security features. WhatsApp ensures that all transactions are encrypted and secure.

Instant Notifications

Businesses receive immediate confirmation of payments, allowing for efficient record-keeping and order processing.

Global Reach

WhatsApp has worldwide users. This tool allows businesses to tap into a vast customer base and expand operations globally.

Reduced Transaction Costs

Businesses can possibly save on transaction fees by avoiding the use of third-party payment gateways.

Seamless Integration With Marketing

Tools such as WhatsApp business API allow businesses to send promotional offers and make immediate payments within a chat, thus improving customer interaction and increasing sales.

WhatsApp Pay can improve the payment experience for both businesses and customers. It has become an essential element for every business that is willing to strengthen its digital presence and to simplify its operations.

Related: How To Send A Broadcast Message On WhatsApp? Step-By-Step Guide!

Use Cases Of WhatsApp Pay For Businesses

WhatsApp Pay provides a range of benefits and can be utilized by businesses in a lot of industries. For instance:

E-Commerce

Businesses can integrate WhatsApp Pay to allow customers to add a desired list of items to their cart and complete the purchase cycle directly within the app. This makes the shopping process more efficient and boosts conversion rates.

Fintech

Companies in the fintech industry can use the payment option of WhatsApp to automate payments for services. It enables them to offer their clients a convenient and secure payment method.

Online Classes & Workshops

Institutions and online platforms can use WhatsApp Payments to collect their course fees and simplify the payment process through quick payments.

Freelancers & Consultants

Professionals can send an invoice for their services, which can be paid after a consultation or project has been completed. This ensures prompt payment.

Restaurants & Takeaways

Customers can use WhatsApp to make their payments directly. This simplifies the ordering process for the client, making the experience smoother.

Event Organizers

With WhatsApp, organizers can seamlessly accept payments for event tickets or reservations and make ticketing a breeze for attendees.

Subscription Services

Companies can send regular payment reminders and collect payments on WhatsApp. This benefits both the company and the subscribers as timely payments are ensured, and the churn rate will go down.

WhatsApp Pay facilitates businesses by making it easy and secure to handle payments, smoothing business operations and improving user experience.

Conclusion

WhatsApp Pay has the potential to be an excellent tool for simplifying transactions and consequently increasing customer engagement. Through its smooth coordination with a quickly accessible functional messaging platform, WhatsApp Pay provides a convenient solution for both companies and consumers. Furthermore, it helps streamline payment processes and establish trust through secure transactions. It could become a means for businesses to improve their operational processes, increase their sales, and strengthen customer relationships.

FAQs

To set up follow the steps given below.

- Ensure you have the updated and newer version of WhatsApp

- Open a chat

- Tap the attachment icon

- Select Payment

- Follow all the prompts to add a payment method and verify your account.

No, currently, WhatsApp Pay is free to use

WhatsApp Pay’s transaction limit per country is different. In India, the limit is Rs. 1,00,000 per transaction and per day.

The pay feature utilizes advanced security payment technology and encryption to keep your transactions safe. However, it is important to apply best practices for online security and privacy.

Dec 11, 2024

Top Contact Center Optimization Tools For 2024

“A thriving business knows how to fetch maximum output from limited resources by optimizing ca... Read More

Nov 13, 2024

What Is Brand Communication? CPaaS Role Explained

Did you ever wonder why some advertisements grab your attention instantly, while others do not? The... Read More

Nov 01, 2024

What Is Automated Messaging And How Does It Work?

Automated messaging or text automation empowers businesses and marketing professionals to connect wi... Read MoreLatest Updates

From Fonada

Industry Insights, Trends, Innovations, Updates, and Case Studies from Industry Experts

View

Customer

Reviews

Discover why our customers love us - read their authentic and heartfelt reviews!

View

Case

Studies

Explore real-life scenarios, offering analysis, and solutions to practical challenges

View

Convert Leads Into Sales With Fonada

Trusted CPaaS Solution Provider