Most banking and financial institutions have embraced the benefits of mobile messaging, but most still need to explore its full potential.

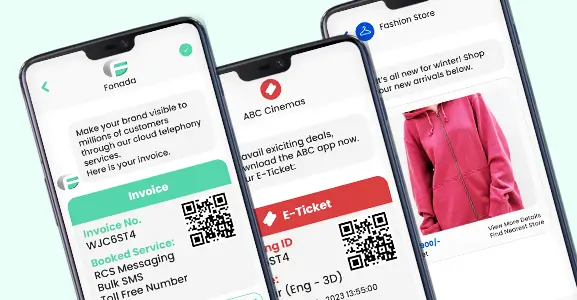

SMS messaging is the best platform for interactions that require easy, in-the-moment engagement. Basic messaging services use cases include two-factor validation and payment alerts, which are merely the tip of the iceberg.

Texting is the most effective method for reaching customers. Get a response rate greater than you would get over the phone or email, which is 98%. SMS is an excellent way to keep in contact with your customers. Messaging opens up enormous prospects for outstanding client experiences — opportunities that banks and other financial organizations cannot accomplish with app notifications and email only.

What Is SMS Banking?

SMS banking is also known as Short Message Service (SMS) banking. It is a service that connects your mobile phone to your bank account, enabling you to receive and send SMS directly from your phone. You can check your account balance, transfer funds across accounts, and make payments. SMS is a quick and effective way to get in touch with customers. It is a fantastic method for banks to give their consumers a seamless user experience.

The concept underlying messaging services is that banks must be capable of interacting with their clients at any time, from any location, and by any channel they choose – email, SMS messages, or social media platforms. Customers can choose their preferred means of communication with the company when they have many options for receiving information.

Read More: Top 10 Most Popular Bulk SMS Service Providers In India

Features Encourage User Interaction And Communication

You can quickly solve problems and deliver answers for your clients using easy, user-centric SMS marketing features.

- Two-way messaging facilitates communication with staff members, bankers, and others.

- Stay on top of the plan by scheduling messages before.

- Invite bankers and assign only their clientele.

- Allow your consumers to text you a keyword they choose to opt-in quickly and effortlessly.

The Importance Of Messaging In The Banking And Finance Sector

Businesses of all types need to adapt to the changing times, especially in the Digital World, where technological advancements seem to emerge at a tremendous speed. Communication is one of the key areas in which we employ technology in business.

Modernizing communications in banking and FinTech is vital for succeeding in a marketplace where these businesses service depositors, borrowers, and anybody engaging with sensitive financial information.

Consequently, meeting clients where they are is essential, which requires adapting to their dynamic preferences and communication services.

Customers expect companies to provide them with the conveniences of service delivered directly to their location:

- Activation of cards and authentication procedures

- Fraud alert Notifications

- Account balance details, payment reminders, and transaction reports

- New services and policies

All of this can be obtained through the round-the-clock customer support service!

Therefore, two-way advanced messaging is trending in the banking and financial sectors. Two-way messaging enables you to communicate and transact directly with your consumers via channels they are already familiar with, like SMS and WhatsApp.

Top 10 Uses Of SMS In Banking And Finance

1. Notifications Of Payment Status

People need to know that their money has been sent and received safely or that money they’re expecting has been deposited into their account. Think about the rent or other regular bills. They can relax when they get a proactive SMS alert.

Banks and financial institutions use SMS notifications to increase process transparency, give customers more control, and enhance customer security and privacy.

2. Payment Confirmation

Any reputable bank or financial institution would like to always check with the customer if a payment appears suspicious (based on variables like amount, timing, or location) without inconveniencing the customer. If your customers are traveling abroad or are in an area without data or WiFi service, payment authentication messages or SMS OTP verification make this process easy for them.

Most financial institutions and banks use short message services (SMS) to minimize fraud and provide consumers with real-time notifications about any suspicious activity, all in real-time.

3. Status Updates

Customers want to know the status of their mortgage application or insurance claim. In the digital age, speed is the benchmark. Timely information regarding bank transactions, address changes, etc., is of utmost importance. This is essential in establishing an environment of trust and for securing customers’ information, assets, funds, and information.

Automated status updates notify customers when key milestones have been reached, eliminating the need for them to contact your service center.

4. Customer Enrollment

Many people today use mobile apps to perform financial tasks like checking balances and making transfers. Setting up a customer for a loan or other banking product might be challenging. With SMS, users can engage in simple, two-way communication that guides the user through the procedure without needing these complicated forms.

It is essential to keep customers informed and tell them via SMS whenever there is an update to prevent fraudulent activities.

5. Renewal Reminders

A simple SMS draws their attention when it’s time to update a policy plan or make a payment. From there, you can direct them to a simple link for renewals or payments – no more missed deadlines! SMS reminders issued on time are as successful as notifying customers that their payments are due, as they are fast, simple, and effective.

They are an excellent way to make the process easier because they include a link to the payment gateway right in the SMS body, so you don’t have to log in or follow a long process.

6. Authentication Of Users

Do you need to verify a customer’s identity to make sure they are whom they claim to be? A simple and secure way to allow access is to issue them with a unique authentication code or a one-time password. The most effective defence against identity theft is two-factor authentication via SMS.

Two-factor authentication with a one-time password is now one of the most popular and reliable solutions to protect users’ personal and financial information in the age of increased customer awareness of the significance of keeping their financial information safe when transacting online.

7. Surveys For Feedback

The SMS channel enables focused and hyper-local engagement, enabling banks and financial institutions to leverage the medium to acquire greater feedback, insights, and customer understanding.

Getting customers to provide feedback can be challenging. Mobile messaging significantly reduces barriers. After a customer engagement, send them a quick, simple survey. It’s a good strategy to find out what they don’t like about your service and fix it before they complain about a specific service or a review site.

8. Updating Personal Details

The use of text messages (SMS) helps speed up the process of providing customer service. It is a source of annoyance for everyone involved when a consumer’s personal information needs to be updated. Automated notifications and simplistic instructions help them keep you informed.

It is fast, easy, and quick to use and only sometimes needs to be connected to the internet. Web-based short message service allows customers to quickly and conveniently contact support professionals with questions via text message.

9. Special Offers & Discounts

Banks and financial organizations use SMS to inform and retain potential consumers interested in new schemes, goods, and services, sometimes offering a direct link to the relevant page.

SMS advertising may turn prospects into customers and customers further into loyal customers. And you may use it to provide special deals and promotions to your loyal customers. Consider offering discounts to your long-term consumers, so they never develop itchy feet.

10. Cross-Selling And Upselling

Banks have an abundance of client information. Using it properly allows businesses to provide clients with relevant and timely offers they are more likely to accept. It is important to remember to appreciate the potential of upselling and cross-selling to existing customers. Attracting the attention of the people uniquely provides financial institutions with a natural opportunity to boost customer spending.

Send them an email containing informational documents regarding your education savings plans. Make it simple for them to initiate a discussion with you.

The Process Of Mobile Banking With SMS

The use of short message service (SMS) mobile banking allows you to manage your accounts from the tip of your fingers. All you require is a cell phone that can send and receive SMS.

When you have signed up for SMS banking, you can access a wide range of available services by sending a text message to a specific number. In addition to verifying your account balance and receiving mini-statements, services also allow you to transfer money to another account and perform other financial transactions.

Just text your desired keyword to the mobile banking unique code provided by your financial institution (for example, BAL for a balance enquiry). You will now receive a response containing the details needed.

SMS banking services are often free of charge from your financial institution; however, your mobile service provider may charge you for each SMS you send or receive.

Read More: Top 10 Best Instant Messaging Platforms In India

Advantages Of Messaging Services In The Banking And Finance Sector

The benefits of using SMS for financial services include improved speed, cost efficiency, reliability, and discrete messages. Text messaging has far higher engagement and response rates than email, which is chosen for its convenience over regular mail and phone calls.

Sending Text Messages: It is also advantageous for consumers, as they do not need to update their passbook to check their bank account and other information. SMS arrives immediately after the transaction.

Saves Time: No need to go to the bank because the information goes straight to the phone. This saves time and effort for both of us.

Inform Your Customers: Keep your clients up to date on any new policies or plans that might interest them. Keep them up to date on everything important.

Cost-Efficient: It is a cost-effective and reasonable method of marketing. Building an effective SMS campaign can be a manageable financial investment.

Error Reduction: It is unnecessary to call customers for every minor detail, as most issues may be resolved via SMS. It also helps reduce errors because most of the activity is automated.

Improved Relationships With Customers: If we write a thank-you message after every transaction, notify them about the schemes they provide, and send messages on important dates such as holidays, birthdays, etc., the relationships with customers will improve. All of these little things will have a great impact on our customer relationships and make them more loyal to our brand.

Conclusion:

SMS is among the most effective direct methods available to banks and other financial institutions. Its exponential growth has become synonymous with consumer satisfaction and involvement. This is because it is quick, efficient, trustworthy, secure, and concise. Experience effective campaign customization and great deliverability.

FAQs

Some financial institutions, such as banks, use this feature to notify customers about important information by messaging it to their mobile phones. Alternatively, they may offer a service that allows their customers to do certain financial transactions through text messages.

Mobile banking refers to all mobile banking transactions, while SMS Banking is a bank service.

You can transfer money to accounts in other Banks via Mobile to Mobile Money Transfer (IMPS) using the beneficiary’s mobile phone and the MMID (Mobile Money ID) given by the beneficiary’s bank.

Sign in to the app and choose the IMPS option from the IMPS menu. You can also use the SMS feature on your phone if your bank offers IMPS on SMS. Get the phone number and MMID of the beneficiary. To send money, enter the beneficiary’s mobile number, MMID, and the amount you want to send.

SMS payments allow customers to pay via text instead of cash, checks, or credit cards. It occurs when a consumer initiates a transaction via SMS and completes it on the smartphone.

A one-time password provides security for financial transactions because it is only valid for a limited duration. They are also more secure and minimize the need to memorize passwords to access the account. OTPs are provided to the user’s registered phone number via SMS mobile banking.

Dec 11, 2024

Top Contact Center Optimization Tools For 2024

“A thriving business knows how to fetch maximum output from limited resources by optimizing ca... Read More

Nov 13, 2024

What Is Brand Communication? CPaaS Role Explained

Did you ever wonder why some advertisements grab your attention instantly, while others do not? The... Read More

Nov 01, 2024

What Is Automated Messaging And How Does It Work?

Automated messaging or text automation empowers businesses and marketing professionals to connect wi... Read MoreLatest Updates

From Fonada

Industry Insights, Trends, Innovations, Updates, and Case Studies from Industry Experts

View

Customer

Reviews

Discover why our customers love us - read their authentic and heartfelt reviews!

View

Case

Studies

Explore real-life scenarios, offering analysis, and solutions to practical challenges

View

Convert Leads Into Sales With Fonada

Trusted CPaaS Solution Provider